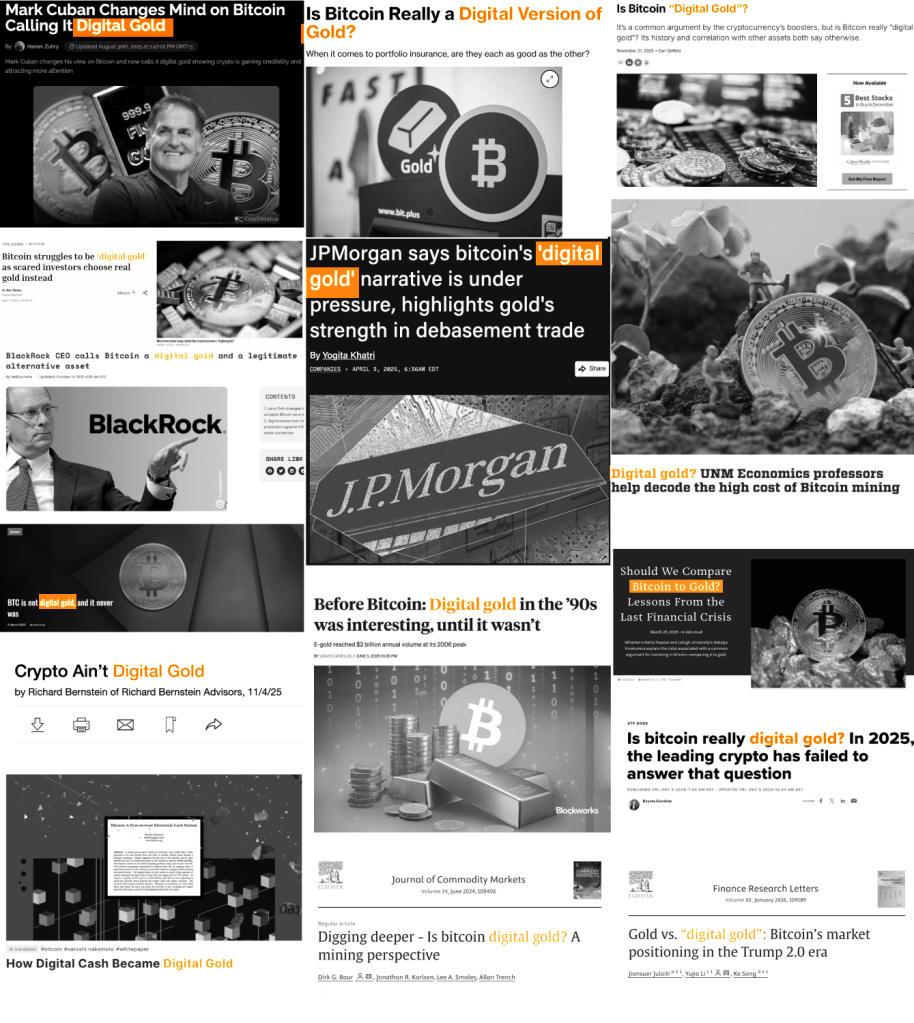

Probably the first time Bitcoin was called “digital gold” was back in 2010 in BitcoinTalk internet forum by a user named “jimbobway”[1]. A decade later it is touted in many news articles.

The similarities are striking. Gold and Bitcoin share notable characteristics: both are stereotypically durable, fungible, and scarce. (Stereotypically, because there are big differences, so it is not one-to-one comparison.) But Bitcoin has distinct advantages over physical gold. It can be divided to extraordinary decimal places, cryptographically verified without risk of counterfeiting, and transported instantaneously across borders. Gold requires vaults, armoured transport, and physical verification.

Not to mention Bitcoin lives in the internet and is hence programmable. This is a very cool aspect in the long run, as new applications are built using Bitcoin’s aforementioned features as their backbone.

Minimally speaking, Bitcoin requires only the memorisation of twelve words. Read it again: Twelve words and you are your own “Swiss bank”, as Barack Obama once said. Of course, not everyone will want to remember the twelve words, so one holds their bitcoin in their own – paper, hardware, or software – wallet by themselves. Or, they hand over their bitcoin to someone who will take care of that for them.

However, “digital gold” is an analogue, and as such susceptible to error, if taken to far greater lengths than the analogue may warrant for.

For one, Bitcoin “mining” is not the same thing as gold mining. Bitcoin “mining” uses the same word as gold mining, but it’s actually totally different – miners are not extracting anything physical from the ground. The term “mining” is borrowed because it captures the same idea of competing to find something scarce, but in reality, Bitcoin miners are providing a service of validating transactions rather than digging up resources.

Secondly, gold has more use-cases than bitcoin, for example industrial applications. However, bitcoin is in this juxtaposition then highly specialised in store-of-value and medium-of-exchange functions (or at the very least may potentially become; currently contested, not to mention unit-of-account). Moreover, while Bitcoin serves secondary functions – time-stamping documents[2], acting as a flexible electrical load on power grids[3], and providing usable waste heat from mining operations[4] – these do not generate the persistent demand across industries that gold enjoys.

Notwithstanding, Bitcoin is perceived and understood as “digital gold” by some and by many. This is evidenced by the U.S starting a Strategic Bitcoin Reserve[5] (although it includes other crypto-assets, too), Bhutan[6] quietly mining bitcoin, El Salvador buying bitcoin, Central African Republic assigning bitcoin as a legal tender, and European banks slowly waking up to the fact, notably the Czech central bank[7]. There are other nation-states also that own Bitcoin[8].

There are some studies already that contend that Bitcoin could be a hedge (like gold) against geopolitical uncertainties. One study finds that gold functions as a more reliable hedge and safe haven for people living in ‘BRICS plus’ countries during market crises, while Bitcoin offers diversification benefits primarily in normal market conditions with limited and country-specific crisis protection[9].

In another study, authors demonstrate that both Bitcoin and gold function as safe havens during high geopolitical risk periods, though their protective effectiveness varies depending on the specific type of geopolitical threat[10].

So described, given the emerging evidence of Bitcoin’s safe-haven properties during specific geopolitical risk scenarios, central banks of their respective countries may also benefit from considering modest Bitcoin allocations alongside their traditional reserves.

Following BlackRock’s framework,[11] a 1-2% allocation to Bitcoin would contribute similarly to portfolio risk as holdings in major tech stocks while providing a distinct source of return uncorrelated with traditional risk assets. Though such risks differ if one is a nation-state, a central bank, a private enterprise, or an individual. Accordingly and naturally allocation differs.

In conclusion, “digital gold” or not, Bitcoin does succeed in its own category that defies the previously-thought schemas. Bitcoin has differing qualities that could make it an increasingly attractive asset to own, even for nation-states. If Bitcoin is enticing for countries, why not for you?

References

[1]

jimbobway. (2010, August 6). Bitcoin as digital gold [Forum post]. BitcoinTalk.

https://bitcointalk.org/index.php?topic=733.msg7939#msg7939

[2]

SimpleProof. (2026, January 16). SimpleProof. https://www.simpleproof.com/ and

OpenTimestamps. (2026, January 16). OpenTimestamps. https://opentimestamps.org/

[3]

Klee, M. (2022, November 1). Demand Response And Curtailment Through Bitcoin Mining. OBM.

https://obm.io/blog/demand-response/

[4]

Asgari, N., McDonald, M. T., & Pearce, J. M. (2023). Energy Modeling and Techno-Economic Feasibility Analysis of Greenhouses for Tomato Cultivation Utilizing the Waste Heat of Cryptocurrency Miners. Energies, 16(3), 1331. https://doi.org/10.3390/en16031331

[5]

The White House. (2025, March 6). Establishment of the Strategic Bitcoin Reserve and United States Digital Asset Stockpile.

https://www.whitehouse.gov/presidential-actions/2025/03/establishment-of-the-strategic-bitcoin-reserve-and-united-states-digital-asset-stockpile/

[6]

Lamsang, T. (2023, April 30). DHI confirms that it is mining digital assets. The Bhutanese.

https://thebhutanese.bt/dhi-confirms-that-it-is-mining-digital-assets/

[7]

Zimmerman, M. (2025, November 13). Czech bank buys $1 million in Bitcoin. Bitcoin Magazine.

https://bitcoinmagazine.com/markets/czech-bank-buys-1-million-in-bitcoin

[8]

Bitcoin Treasuries. (2026, January 16). Governments holding Bitcoin.

https://bitcointreasuries.net/governments

[9]

Belguith, R., Alnafisah, H., Manzli, Y. S., & Jeribi, A. (2025). Bitcoin and gold as hedges during geopolitical risk. Emerging Markets Finance and Trade.

https://www.tandfonline.com/doi/full/10.1080/1540496X.2025.2486677

[10]

Selmi, R., Bouoiyour, J., & Wohar, M. E. (2022). Safe haven properties of Bitcoin and gold. Journal of International Financial Markets, Institutions & Money, 76, 101487.

https://www.sciencedirect.com/science/article/abs/pii/S0275531921001331

[11]

Cohen, S., Henderson, P., Mitchnick, R., & Paul, V. (2024, December). Investment perspectives: Sizing bitcoin in portfolios. BlackRock Investment Institute.

https://www.blackrock.com/gls-download/literature/whitepaper/bii-investment-perspectives-december-2024.pdf

Leave a comment