It has been a while since I wrote about crypto or Bitcoin. I went to a crypto launch event for an upcoming crypto conference that is held in following May. I found all kinds of opinions there. It sparked me to write about it.

Maximalists

So once upon a time there were “bitcoiners”, and especially the “maximalist bitcoiner” breed who are the ardent early disciples of Satoshi: They do not go well with ‘shitcoiners’ or even ‘nocoiners’ (respectively; those who own something else but not bitcoin, and those who own nothing but normie money). This is their cultural talk by the way. A more neutral way would be to say ‘altcoin’, or alternative coins, from their perspective.

This tribalistic nature is common and even desired. It protects people from losing their hard-earned money to various ‘scamcoins’ and rug pulls, deception and horse dung. Just as hardcore Christians are preached to avoid mingling or listening or marrying nonbelievers. (For better or for worse.)

At the same time, it can make someone a bit narrow-minded within their respective echo-chamber, if not open for other alternative ways to solve a problem, but also zealous within one’s own domain too. Well, I am also making a stereotyping error here; real life is much more messier, divisive, and vibrant.

These disciples, or knights of Nakamoto, envision Bitcoin becoming a world currency. Some people have been named Bitcoin Evangelists and there is even book named Bitcoin Prophecy. People believe that “Bitcoin fixes the money and therefore the world”. There’s some who, especially during the Block Wars of 2015-2017, trust the Bitcoin Whitepaper with absolute conviction as if it was a holy book. Then there’s the ritualistic celebration of Bitcoin’s Genesis Block every January 3rd, the ceremonial “proof of keys” movement where hodlers withdraw their coins from exchanges to assert sovereignty. And there’s also the Bitcoin Halving Ceremony that happens every four years. No worries. It is not an organised religion, I promise.

Though note that a religion requires belief without proof. Bitcoin explicitly demands the opposite, saying “Don’t trust. Verify.” That’s the antithesis of religious worship.

The landmark characteristics of bitcoin maximalists are as follows.

- Bitcoin is the only legitimate cryptocurrency.

- Absolute trust in decentralisation and immutability.

- Self-custody is a moral obligation.

- Hard money fixes societal failures.

- All altcoins are scams or distractions.

I emphasise with “bitcoiners” given that it is easy to get greedy, or plainly sidetracked into wrong paths, and then exchange bitcoin into altcoin, and then get scammed slowly or instantly, or just eventually not make the money worth its time. Certainly even if those characteristics are opinions of bitcoin maximalists, it goes without denying that those are also characteristics of the very protocol that ought to include them: open, permissionless, neutral, censorship-resistant, decentralised.

Moreover, just because there are religious characteristics in some people within this space, the majority are not. Most are just in it for the money, or in it for the censorship-resistance. Depends on whether you come from the Global North or the Global South.

But I understood quite quickly from the people who attended the event that people definitely do not see things as I do. They are not bitcoin maxis, but am I either? I just have my reasons not to get into non-bitcoin stuff albeit I am neither working or investing. I am not so extremist but I am skeptical.

At the same time, I welcome the diversity of beliefs that drive efforts, which make life potentially easier. But how do you know the good from the rotten in this space?

Decentralisation

In addition, even though financial regulations are making some good and bad constraints for companies developing the protocols, and perhaps helps consumers make educated and safer decisions, the actual output seems to be nothing but price speculation, gambling, and playing games with money. That can definitely be its purpose, but I find that incredibly shallow and boring. Only Matt Levine makes it look tasty.

Maybe I am idealist – as I think meat eating is not sustainable nor ethical, and that conscription is wrong yet maybe necessary but still good not great – for saying that scene does not follow the decentralised ethos anymore. That is, power back to individuals, freedom without intermediaries, code over authority, self-custody first, and open and permissionless access.

Strange, forgotten words to some, but that was the primordial wet dream that early geeks and hackers had. Now it is power back to status quo, neobanks as custody-providers, crypto as an investment property, and authority over code. The latter one is super evident in almost all crypto projects: the code can be changed on a whim after something undesirable happens or is not wanted to happen.

There’s almost nothing decentralised about non-Bitcoin endeavours. Then again, Bitcoin, too, is not without its own problems. And maybe it was never about decentralisation for the normies, but about efficiency.

But normies mistake efficiency for easier life. What do you do when you are not able to withdraw more than 1000 euros worth of satoshis from your bank account? This is coming. We are trading efficiency for freedom. Dictatorship is efficient while democracy is designed to be slow and cumbersome. Too much efficiency makes everything worse.

Inevitability

Then again, perhaps it was always meant to be this way: after all, the world was built such that the law goes first and then all else after. Institutions precedes technology. Crypto without law is anarchy, and we don’t want to live in anarchic world as depicted by International Relations Realism. Therefore, the contemporary structures and institutions with their property laws and financial regulations absorb crypto in itself and shape its use and availability through its long-preceding processes to its own mold.

For example, given that (some) crypto is open and neutral, the compliance-industrial complex uses that very fact for their own gain, and installs the rent-seeking vampires into the processes of using crypto. Thus, the 5AMLD, MiCA regulation, and Travel Rule, and whatever comes after, were predictable within their own systems. Therefore, to really want crypto to be different is to change the law, be it through democratic processes or through nonviolent movements after period of dissatisfaction.

But friends, this perspective is merely Eurocentric that doesn’t take into account rest of the world that live under authoritarian regimes. Just because we can play money games and have access to bitcoin and other related crypto, the rest of the world cannot. Today, 5.7 billion people – 72% of the world – live under authoritarianism. Even our democracies in Europe are backsliding into populism and fascism. The United States is crumbling already.

All governments, especially those of dictators, frequently debase, manipulate, demonetise, and surveil currencies, confiscate property, and freeze the bank accounts of people they don’t like. Dissidents, human rights defenders, journalists, and nonprofit organizations in authoritarian countries face enormous obstacles just to receive donations and pay bills.

Web3

I met people who had dollars in their eyes. It is highly common that many people in this sphere seem to idolise money. And how could one not? It is hyperfinancialisation at its finest. Bitcoin is money, and all its descendants are monetised abstractions.

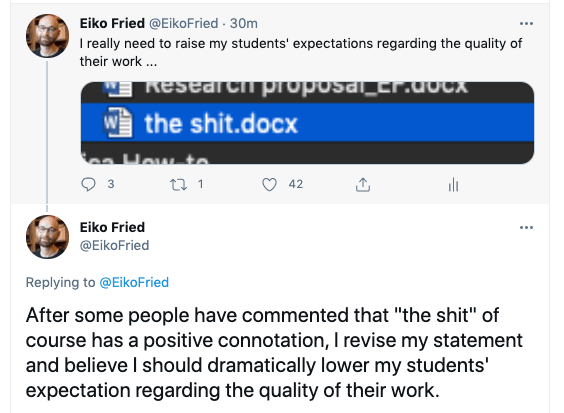

There is indeed a ton of money in Web3, DLT, ICOs, NFTs and all that fun. No need to get into opening those abbreviations here. (And now it is officially by lawmakers called “crypto-assets”; BORING!) And see? It is so damn confusing and at this point I can’t really fathom why would anyone think this is “the shit”?

(Digression: I gave my then bachelor thesis supervisor my second to last version of my thesis and named it ‘the shit.docx’; He shared it in then Twitter and I had my laugh.) Back to the points.

Back to my original rant. The roots whence we came from has been forgotten as the new baby is taking its first steps. Well, I guess we have to see if it pays off. I certainly do like some of the things that happen in Ethereum ecosystem, such as the Decentralised Autonomous Organisations (DAO; Yet another term, sorry not sorry!).

It is a way to organise tasks and handle money without the need for intermediaries to do it. Instead of keeping track of who owns what, it is a digital organisation where everyone holding its tokens can vote on rules, decisions, and funds, so the whole community runs it together without a single boss or company in charge.

I heard a story Cecily told me about the UkraineDAO, which raised some 10 million units of money to help provide humanitarian aid to Ukraine. So these innovations have legitimately brought about meaningful change to some peoples, and broken perceived barriers in how things are arranged and organised. Though, she mentioned, that it was very much in the beginning and they didn’t follow the legal structures and processes that well.

Based on my observations, a DAO will need a legal wrapper to make it work in the real world. Thus, whatever nice technological intricacies and features it has, it inevitably cannot use those to its fullest potential because of the legal wrapper. For example, companies had the chance to build stablecoins with interest-generation in Europe, but now the issuers are not able to provide such a service because the legal underpinning forbids that (Article 40 of MiCAR).

Censorship

I did my thesis on Financial Censorship and how to use Bitcoin to circumvent (or avoid, or fight, or whatever euphemism/dysphemism you wish to use in this sensitive context) censorship by the actor, be it a company or a state. In this case, I only researched which entities used bitcoin to fund their causes. As such it was limited to bitcoin-only research, but I came across many different attempts through other crypto-assets, such as Stellar Lumens and Tether in Myanmar.

Also, censorship could’ve been defined more broadly, but I kept it more specific for research purposes. For example, one could perceive capital controls as means for censorship or at least obstructing the flow of money. I personally defined it as a freeze of transactions or seizing the assets. One could also see censorship as a blanket ban of cryptocurrencies, such what the UAE did recently with tools like self-custodial wallets, effectively killing any attempts to go past censorship.

For example, I heard from a Russian friend who held stablecoin Tether in custody. They sold their rubles in Russia to Tether in an exchange, and then sold Tether to euros and withdrew them to a bank in Finland. As such, they avoided such “censorship” by the EU sanctions against Russia. Albeit I do wholeheartedly support such sanctions given the larger context, though such a blanket ban inadvertently harms all Russian citizens. Quite brilliant from my friend though.

In this way, the “non-bitcoin” attempts to make life better seem good, as the UkraineDAO and stablecoin examples in the censorship scenario show. So I shouldn’t take it as just “mere” Web3.

I am still skeptical, but also because I haven’t researched the space that much. I don’t live in it. But you know why? Because I wan’t to keep my life simple. All those terms are just way too much, my time is more precious, and the risk is too big. Bitcoin is simple, predictable, and straightforward. Even Human Rights Foundation and their initiatives include only Bitcoin because they know crypto as such doesn’t cut it.

I just don’t have the energy in me to research every token and every new term that the space throws at me. I believe that people may get confused. Confused as to what matters. The signal is lost in the sea. And the sea is treacherous and deceiving and your whole life savings may be lost. Because of this very reason, there was indeed a smart-contract developer in the event who had not bought a single two satoshis because they found the risk too big even though they work in the field. Not even bitcoin.

I think he made a categorical error to treat bitcoin as “just another cryptocurrency”. No! Just see historical charts and models, and compare those to other cryptocurrencies. All come back to bitcoin when push comes to shove. And just because your company or project is not “like the others”, it is really, really difficult to discern the Truth from the Scheiße.

I’ve started to find the crypto space boring. There is a lot of hype and hustling, but to what end? Really, ask yourself if you work in this: To what end? Do you just work in this field, because it makes you money? Really? Then it brings about nothing. Well, if you want to play money games, then money games it is. But it does seem to me that even if you get a cool new technological innovation, it is now slowly evident that it is being wrapped under legal and institutional shells and domesticated to the status quo that was and is the contemporary financial system. It is being co-opted.

We let is slide willingly to a territory from which there is no going back. The crypto-“asset” looks more like an investment vehicle and digital capital, but only within the Walled Garden we have built in the Developed North.

Conclusion

So these are my thoughts. I met quite different people at the event and I got ideas. I am still trying to understand whether or not and what kind of role I have in this space. I am still quite interested understanding the ethics of Bitcoin as well as the use and philosophy of Bitcoin in human rights and larger societal phenomena. I am sorry, but Web3 for all its glorious purposes has not convinced me of its larger promise. Maybe later?

Bitcoin is simple. 21 million units, the use case is straightforward, the ethics and philosophy has stayed intact since its inception, and there’s relatively less drama going on compared to all the rest. Keep it simple stupid.

The boat has not sailed for Bitcoin even if we think so, but for what the Web3 amounts is full of “boating accidents“. Or to put it correctly, such protocols are hacked on a regular basis quite often. Bitcoin is still here and I see it will continue to be here, even after quantum computing. Before I leave the event, a fella who drank too many free beers pats on my shoulder and says: it is what it is. I say back to him that: it is not what it is not.

Leave a comment