0 hyperbitcoinisation

Imagine waking up one ordinary Monday morning in 2055. Your home’s temperature adjusts perfectly as you rise, powered by the excess heat from the local Bitcoin mining cooperative that keeps the entire neighborhood warm while stabilising the grid as well as the electricity prices across your region.

You scroll through your favorite forum where someone’s insightful comment catches your eye. With a simple tap, you send them 500 sats as appreciation. No ads interrupt your reading—the entire platform runs on micropayments instead of surveillance capitalism. Content creators make a living directly from their audience rather than chasing engagement algorithms.

Walking to the local market, you notice prices displayed in both sats and perhaps your regional currency. Your weekly grocery budget hasn’t changed in years—the stable unit of account makes long-term planning effortless.

At lunch, your friend mentions she’s moving to the new Mars settlement next year. “Won’t your business suffer?” you ask. She chuckles, explaining that with quantum-entangled Bitcoin nodes, she’ll handle payments instantaneously regardless of planetary location. Distance has become irrelevant for value transfer.

On your way home, you pass the old museum of financial history. School children crowd around exhibits of money, bank branches, and something called “KYC forms.”

The guide explains how people once needed permission to move their own money and couldn’t send value across borders without large fees and delays. The self-custody revolution ended the compliance-industrial complex decades ago, establishing the right for financial privacy as fundamental as the right for free speech.

—

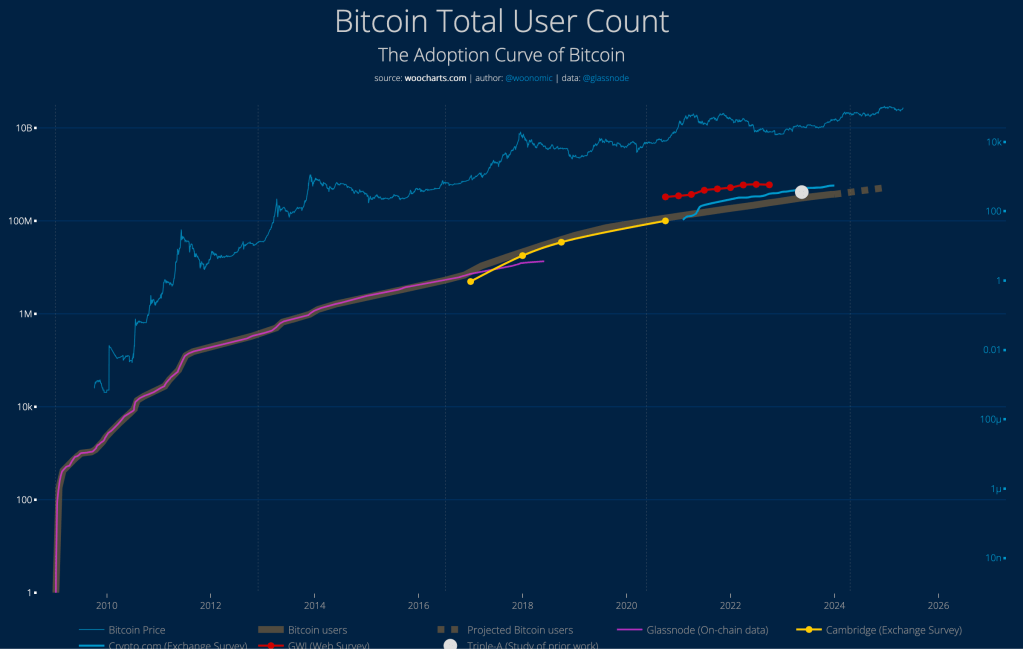

Bitcoin has become the base layer of money, a world where hyperbitcoinisation has occurred as per Thier’s Law. From zero to one, ten, hundred, thousand, ten thousand, hundred thousand, million, and to ten million. Bitcoin has no theoretical upside limit.

Hyperbitcoinisation is the rapid and complete shift from traditional government-backed currencies, or fiat money, to Bitcoin, driven by people losing trust in contemporary financial institutions. “Fiat” in fiat money means that the money has value because a government declares it to be legal tender, not because it is backed by a physical commodity like gold or silver. Contemporary money is vastly debt.

But how do we get from here to there? What conditions would need to happen for Bitcoin to transition from its current status as “magical internet money” to the fundamental architecture of global finance?

For starters, the use of Lightning Network (LN) and other scaling solutions would be ubiquitous in daily use, handling billions of daily transactions with fees so minimal they’re barely perceptible.

LN is a system built on top of Bitcoin-protocol that lets users send small payments instantly and cheaply by creating private payment channels between them, instead of recording every transaction on the main blockchain. This helps.

Importantly, custody solutions would need to evolve beyond the current “be your own bank” paradigm that puts the entire burden of security on individuals. Something akin to community custody as Fedimint suggests.

The OG bitcoiners with their air-gapped computers and metal seed phrase backups would still exist, but babuškas would need to be able to use Bitcoin without living in continuous fear of losing their life savings because they clicked the wrong button or a nefarious actor cloaks the transaction address with theirs. Indeed, even large exchanges may lose their customers’ assets this way, as happened with Bybit.

Contrary to some narratives, hyperbitcoinisation wouldn’t necessarily require an apocalyptic collapse of the existing financial system. It could instead emerge from a series of smaller monetary crises—the continued quiet erosion of purchasing power that is so normalised we barely notice it anymore.

When your fiat currency loses double-digit value each year, the relative volatility of Bitcoin begins looking rather stable by comparison. Although, today many still opt for stablecoins because, well, they are stable as the name implies. They are the euros and dollars but built on various blockchain alternatives.

People aren’t adopting Bitcoin because of a philosophical alignment with Austrian economics, but from the practical necessity of preserving their labour’s value. In the future, when the value of bitcoin is no longer making huge returns, and is valued in multiple millions, the volatility is that of a stablecoin. Already we can see that bitcoin volatility is decreasing as it matures.

Geopolitically, nations seeking alternatives to dollar hegemony might embrace Bitcoin as a neutral settlement layer—not because they love decentralisation, but because they prefer a system where no single nation holds the monetary lever. Ironically and funnily enough, even the current US government is hedging a bet against their own horse with the new Strategic Bitcoin Reserve. Here is a list of other nations and companies betting on bitcoin.

In any case, this can create an interesting game theoretic situation where early national adopters, such as El Salvador, may gain advantage and others follow suit defensively. Although such advantage is yet to be observed. Only time will tell.

—

Educational transformation would need to occur—not just about Bitcoin specifically, but of money itself.

Vast majority of the people, including many economic policymakers, have never seriously questioned how money (or debt) works, why inflation exists, or what gives currency value, and the ethics of all this. This monetary illiteracy isn’t accidental; it’s quite useful for maintaining the status quo.

We don’t understand money, but we do have faith in it and on those who have the power to create it. Money has become the new object of worship in contemporary society, shaping people’s values, desires, and sense of purpose much like God once did. Where faith once directed devotion toward the sacred, today that devotion is often redirected toward wealth, status, and material success.

Ironically, Bitcoin too is an object of worship for many. Now I will go on a fascinating tangent!

The crypto-community, namely “bitcoiners”, have a quasi-religious romanticism toward the technology, filled with myth, faith, and rituals fed by memes.

For example, some people have been named Bitcoin Jesus and there is even book named Bitcoin Prophecy. People believe that “Bitcoin fixes the money and therefore the world”. Even I once naïvely wrote that Bitcoin is a “new beginning“.

There’s some who, especially during the Block Wars of 2015-2017, trust the Bitcoin Whitepaper with absolute conviction as if it is a sacred, religious text.

There’s the ritualistic celebration of Bitcoin’s Genesis Block every January 3rd, the ceremonial “proof of keys” movement where hodlers withdraw their coins from exchanges to assert sovereignty. And there’s also the Bitcoin Halving Ceremony that happens every four years.

No worries. It is not a cult. I promise.

—

So how does money work?

As far as I understand—and I could be wrong—most contemporary economic models often treat money, debt, and inequality as external issues.

Banks create most of the money supply by issuing loans, meaning money is created as debt with interest.

Inflation—perceived as rising prices and falling purchasing power—is one part of the story, but much of the pressure on companies comes from the need to repay their debt with interest. Central banks adjust the interest rates of the debt.

As such, businesses often raise prices, shrink product sizes (shrinkflation), and/or cut quality. Across the entire supply chain, from farms to supermarkets, each link must focus first on profitability and debt repayment, not necessarily tracking ardently how much M1, M2 and M3 money exists in the economy.

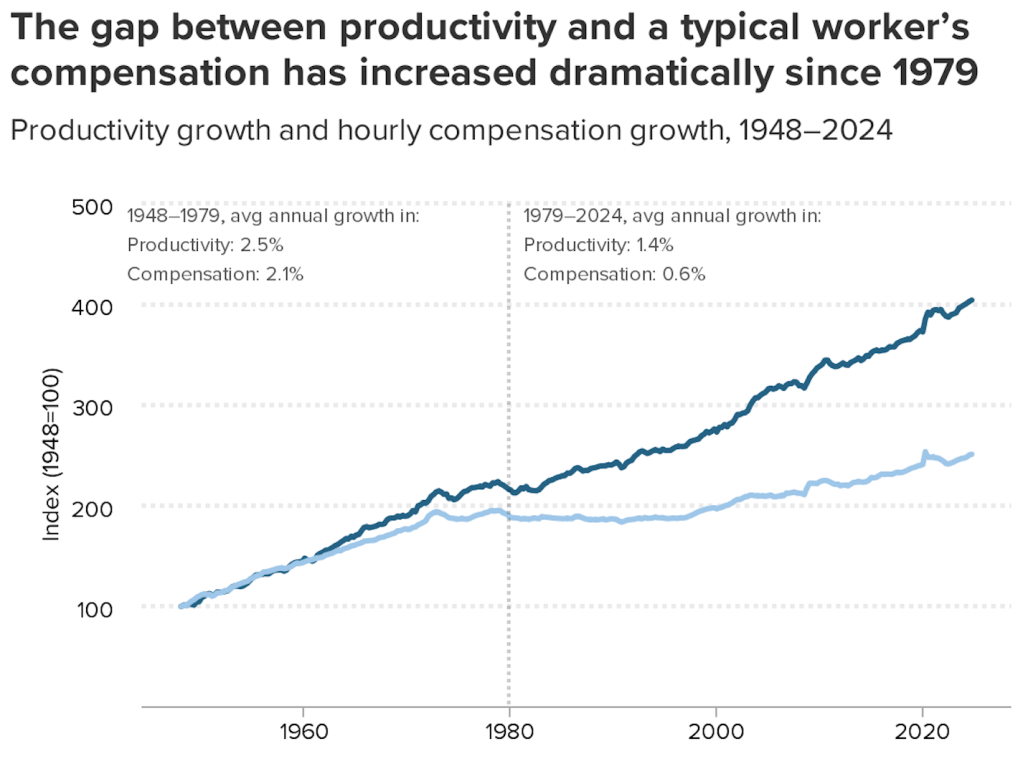

Debt creates long-term dependence. As the real value of wages stagnates while living costs rise, that dependence deepens.

—

In a sense, we sacrifice our health in order to make money. Then we sacrifice money to recuperate our health. And then we are so anxious about the future that we do not enjoy the present. The result being that we do not live in the present or the future; we live as if we are never going to die, and then we die having never really lived.

And mind you that there is nothing tinfoily nefarious about “printing money out of thin air”. Being humanely ignorant and letting it happen is as much taking part in the system as is for those who have the knowledge and ability to greedily exercise that power. This banality is our current reality. This is how economists have studied this for decades and justified its existence. Accept it without adding conspiracy theories.

Fiat money has etched itself into the government institutions at large making it hard to change it from the inside anymore. We can make more rules to tend the symptoms, but it won’t fix the root issue. This is why Bitcoin is a perfect solution to the current broken money.

The timeline for these changes could span decades. The current fiat monetary system was born in 1968-1971. The full transition to a Bitcoin Standard is likely to happen in decades rather than years.

Interestingly, hyperbitcoinisation might not arrive as a single recognisable event. We may instead see Bitcoin gradually absorbing different functions of money in different contexts and times. I see that Bitcoin is first going to be a store of value after which its volatility decreases and later becomes a medium of exchange (and only if it is no longer taxed as a capital income).

The end result might not be a world where everyone consciously “uses bitcoin,” but rather one where Bitcoin-based infrastructure underpins many systems people use without necessarily understanding the underlying technology—much like most internet users today don’t understand TCP/IP protocols but benefit from them nonetheless. So won’t worry if you don’t understand Bitcoin technically.

—

Having studied peace and nonviolence, I find that the most intriguing thing hyperbitcoinisation is that unlike previous monetary systems, Bitcoin is not going to depend on conquest, colonisation, or coercion to spread. Instead, it’s an opt-in system that succeeds through voluntary adoption when it provides superior utility for the person. No need for Great Empires or conquerors.

Money is, after all, how we collectively measure and exchange human time and energy. When the fundamental nature of money changes, so too do the incentives that shape individual behaviour, communities, and eventually civilisation itself.

Now I explore the less-known aspects of Bitcoin, and examine how these changes might change our world.

1 dematerialisation of wealth storage

For millennia, wealth storage has been inextricably linked to physical space. Land, property, gold—all require physical presence, physical security, physical maintenance. Bitcoin represents the first dematerialised form of wealth storage in human history.

It is wealth that exists solely as encrypted data rather than tangible assets you can touch and see. It reshapes our relationship with ownership itself. I remember my first experience with holding my bitcoin in the wallet: there was something rebellious, empowering, and futuristic about it.

This differs from owning a rare and most expensive collectible like Red partyhat in RuneScape because the company behind it owns the asset and can take it away, whereas my bitcoin is forever my bitcoin. Egoistic, but necessary for well-being.

Bitcoin breaks the troubling cycle of wealth concentration that distorts housing markets.

When investment firms and wealthy individuals pour billions into property purely as inflation-resistant assets rather than places to live, they effectively transform a basic human need into a speculative vehicle. Families can’t afford homes, not because of natural scarcity, but because these properties have become wealth storage units for the rich.

Real estate is not a great store of value compared to Bitcoin anyway.

In his tweet, Anil Patel points out how land inflation erodes value, as land can and has been manufactured (e.g. Dubai). Moreover, real property decays, is maintenance-heavy, taxed, jurisdictionally impaired, rentable only at coarse intervals, indivisible, developmentally-constrained, hard to transfer property rights, slow to upgrade digitally, visible and thus vulnerable, burdened with high transaction costs, and is susceptible to confiscation and inflation.

Rather than competing with ordinary people for limited housing, the rich can store value in Bitcoin that actually benefits everyone from increased participation. It is a Number Go Up technology.

However, a word of caution: If you consider Bitcoin merely a Number Go Up technology, i.e. wanting to get rich, but not Freedom Go Up, you are missing the big picture. As Jameson Lopp tweets,

you end up with bagholders salivating over enterprises buying bitcoin IOUs. It’s incredibly boring and somewhat depressing.

That is, from the Bitcoin Whitepaper, “the main benefits are lost if a trusted third party is still required”. Thus, Bitcoin becomes A Regulated Custodian-to-Regulated Custodian Electronic IOU System.

Then you have understood Bitcoin wrong.

2 stable units in an unstable world

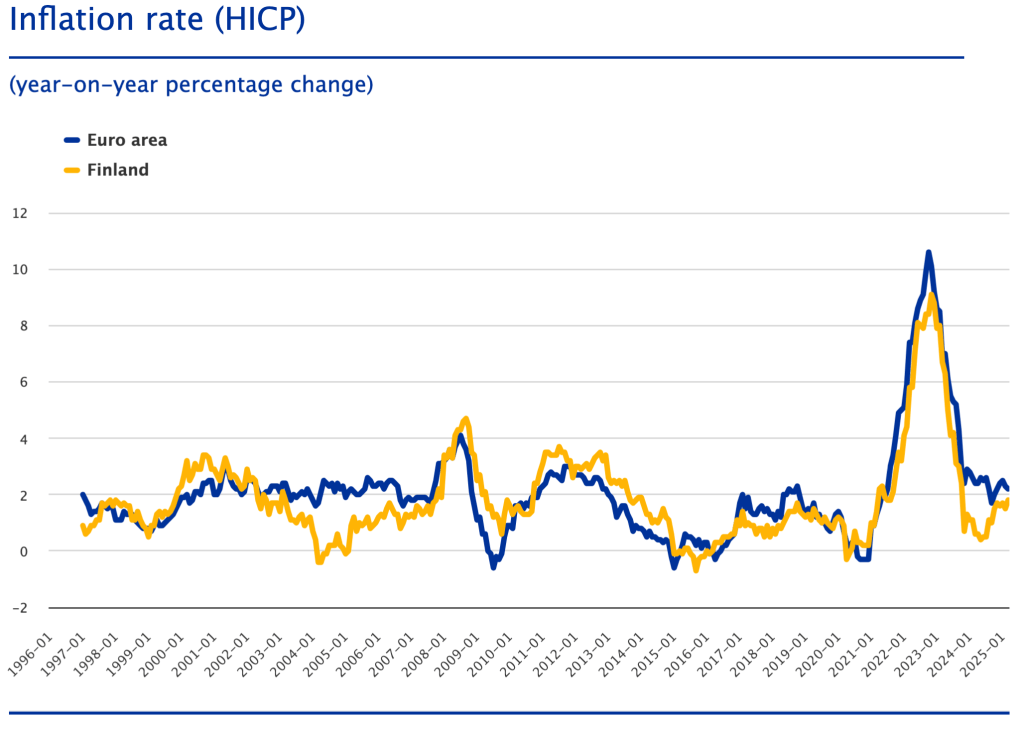

We take for granted the stability of units like meters, seconds, and kilograms. Imagine trying to function in a world where the definition of a meter changes unpredictably. This is precisely what happens with “two percent inflation norm“—the unit of account becomes unstable in the long run. But inflation has not been maintained predictably constant as we can see.

Bitcoin gives a guaranteed finite supply, making it a consistent measuring stick for economic value across time. In economic terms, “price signals” remain more accurate, and as such, labour and goods can be priced better.

Imagine Liisa who lives in Helsinki’s Kallio district. Her grandparents purchased their first apartment for 78,000 Finnish markka in 1980. By the time Finland adopted the euro in 1999, similar flats would be selling for hundreds of thousands. Today, that same modest two-bedroom flat would fetch easily 500,000 euros. The physical structure hasn’t fundamentally transformed—the measuring stick itself has shrunk dramatically.

3 post-advertising social media

Bitcoin has enabled micropayments in Nostr-protocol through applications, such as Primal, and forums like StackerNews. They are platforms built around value-for-value exchange rather than revenue from advertising and data harvesting.

Nostr is also amazing because one can use one “account” across all applications built on Nostr. It’s like you logged in from Twitter to TikTok with the same account, keeping the followers, and having an uncensored voice.

Now, rather than algorithms designed to maximise engagement and advertisement views, content spreads based on actual value provided. Journalists, developers, and artists can receive satoshis directly from their audience through integrated LN wallets. I’ve tried it and it is super refreshing.

The creator-audience relationship changes when creators get paid directly by fans instead of relying on sponsors and ads. When you make money from people who actually like your stuff (not from companies trying to track or influence them), it changes things.

The internet doesn’t have to run on surveillance capitalism anymore.

4 energy systems

The Finns are ardently following hourly electricity prices and changing their living habits accordingly. My parents, for example, have stopped heating the sauna or starting the oven in the evening, because prices spike so high.

It feels like we’re living in rural Africa despite having abundant energy. This constant price rollercoaster comes from the big challenge of renewables: solar farms only work in daylight and wind turbines only spin when it’s windy.

The power grid is like a giant seesaw: supply and demand have to match exactly all the time. Traditional generators (coal, gas, nuclear) can throttle up or down to keep the grid steady, but solar and wind can’t—they only produce when the sun shines or the wind blows. That variability makes it hard to keep the “heartbeat” of the grid (the frequency) right, so operators sometimes have to waste clean energy by turning renewables off or ramp up expensive backup plants at a moment’s notice.

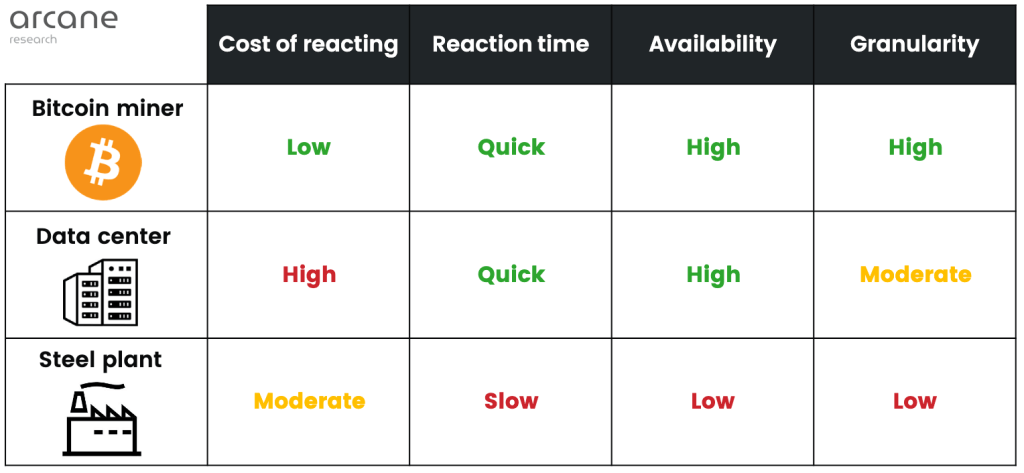

Bitcoin miners are one of the few “loads” on the grid that can go from full power to zero in under a minute without any damage or lost work. That makes them perfect for demand response: when renewables are flooding the grid midday, miners crank up and soak up the extra electrons; when demand spikes in the evening, miners shut down and free up that capacity for homes. They’re more nimble than factories or data centers.

Note that miners only consume power—they don’t generate it—so they can’t replace batteries or gas turbines once the sun goes down or the wind stops. Instead, they’re a fast, interruptible sponge for surplus renewables, helping to reduce curtailment and the need for peaker plants.

Bitcoin mining can play a valuable role in making grids cheaper, greener, and more reliable—without subsidies or complex central planning

In Virunga National Park, Congo, miners now monetise spare hydropower to fund park rangers and save wildlife, while in Bhutan surplus hydro drives national mining programs. Even stranded or remote sites, like one African village, can turn otherwise wasted energy into Bitcoin, funding local services.

Finally, many mining projects, such as that by Marathon now capture and reuse the heat produced by mining, heating some homes of a small town in Finland. Greenhouses may also see some use of bitcoin miners in the future.

5 censorship-resistant donations

I defended that bitcoin can be used as a nonviolent tool against state financial censorship. Human rights activists and organisations fighting for better living under dictatorship make use of the censorship-resistant donations. I wrote it because too often Bitcoin is labelled as drug money, funding terrorism, and wasting energy. I made a study showing how, indeed, at least one media platform in Finland displays Bitcoin in negative light.

In Canada’s Freedom Convoy protests in 2022, truckers challenged government Covid-19 mandates. Then authorities, with a simple administrative order, froze bank accounts and crowdfunding. The message was clear: step out of line politically, and your access to the economy can disappear overnight. Bitcoin emerged as the only viable alternative for supporters to fund the protest.

In Nigeria, the Feminist Coalition supporting EndSARS protestors found their bank accounts restricted and payment links mysteriously “malfunctioning” after challenging police brutality.

In Russia, the Anti-Corruption Foundation investigating Kremlin officials saw their traditional funding channels systematically dismantled before being labelled an “extremist organisation”—putting anyone sending them money at risk of terrorism charges.

For bitcoiners, these aren’t surprising developments but predictable consequences of contemporary financial systems. Self-custody isn’t just a libertarian vision or a fight against the compliance-industry complex—it’s become an existential necessity for civil society organisations operating under autocratic regimes where over five billion people currently live. That’s over half of the world.

The transition from traditional funding to Bitcoin typically follows a predictable arc: first, organisations establish multiple funding channels; then, as authorities squeeze conventional options one by one, Bitcoin moves from backup plan to primary lifeline.

The prudent approach is pre-emptive adoption rather than scrambling to learn complex self-custody practices under active repression.

For activists facing financial blacklisting, NGOs navigating increasingly restrictive “foreign agent” laws, and journalists reporting against powerful interests, Bitcoin isn’t an investment thesis. It’s protection against having their economic existence erased with the banal click of a mouse.

6 intergalactic value transfer

Imagine that there is a synchronised node between Mars and Earth. This happens with quantum entanglement. When particles become entangled, they share a state regardless of the distance separating them. Changes to one particle instantaneously affect its entangled partner, even across vast cosmic distances. When a transaction is verified on Mars, the entangled qubits on Earth register this verification simultaneously, and vice versa—no 20-minute light-speed delay required.

For the average space settler, this means seamless financial integration regardless of location. A Martian ice miner can instantly pay for goods manufactured in Earth orbit using the same Bitcoin network, with the same settlement assurance, as someone buying coffee in Tampere. (By the way, did you know that Tampere is the most electric city in Finland? Because it is called T-Ampere.)

7 challenges and limitations

The fight for private communication and private money began decades ago.

Long before Bitcoin, cypherpunks tried to build private electronic money. In the early internet times, experiments like DigiCash, Bit Gold, and various other gold- or dollar-backed tokens showed how users could send digital coins online. These systems tied themselves to a company. This invited banks and regulators to step in. And under legal pressure, owners faced fines or simply had to close down.

Similarly, during those early times in the 90s, Philip Zimmermann created PGP (Pretty Good Privacy) to let people scramble their emails so only the intended reader could read them. Back then, the U.S. government called strong encryption a weapon and tried to treat PGP like military hardware. Zimmermann faced a criminal investigation for exporting “munitions” without a license.

Now a similar fight is happening with Bitcoin. The U.S. government sued two big privacy tools, known as “mixers”, Samourai Wallet and Tornado Cash. Mixers are pieces of code—built to protect privacy—but because anyone (including criminals) can use them, regulators go after the developers themselves. It’s a bit like suing a hammer maker because someone used a hammer to break a window: the tool didn’t choose how it was used.

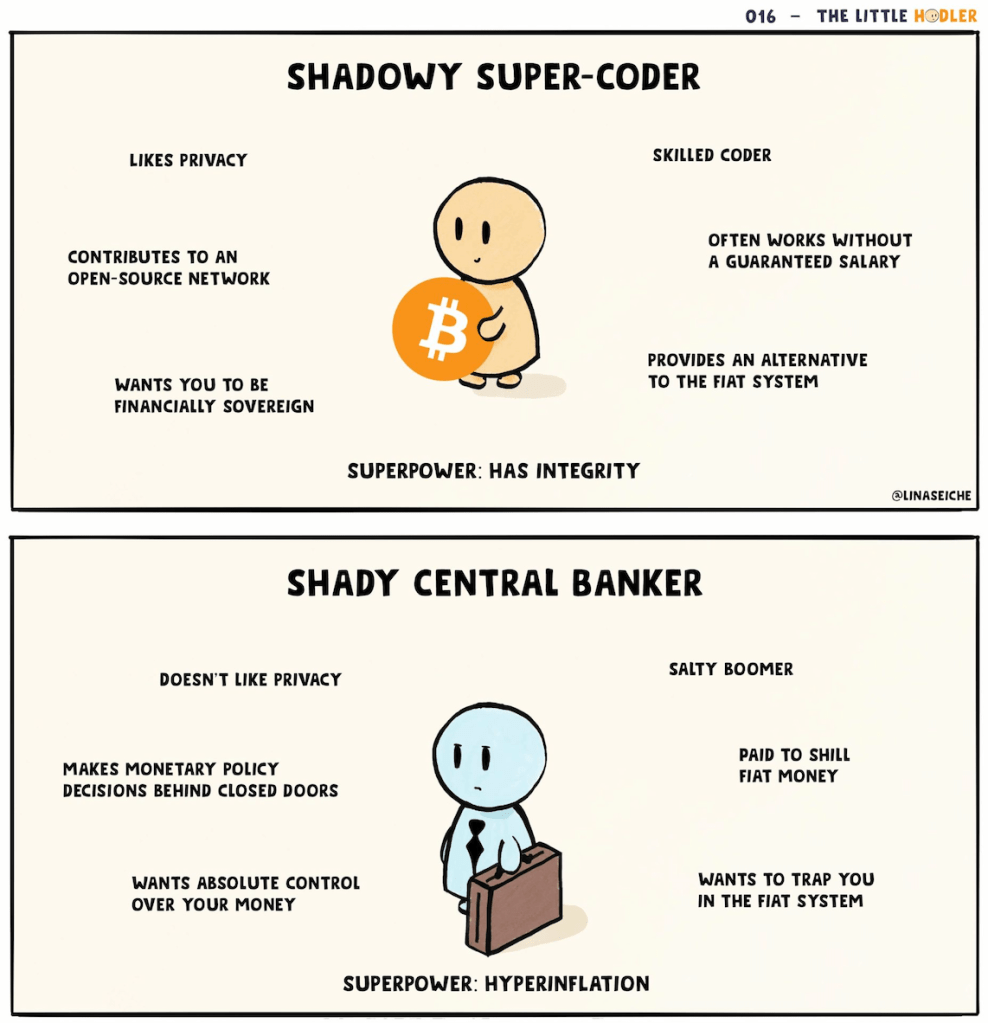

Then there’s the mastermind and the enemy of self-custodial wallets and anonymity, the Financial Action Task Force (FATF). It’s a US-led “deep state” organisation, with unelected bureaucrats, which has no political oversight, and promotes the surveillance state as a political interest of the US.

In finance, everyone is deemed guilty unless proven otherwise through surveillance. This is opposite to criminal law, where every individual is presumed innocent until proven guilty in a court of law.

FATF issues “guidance” that national authorities must follow, or else, risk being blacklisted in the mafia style. They can’t ban bitcoin and crypto, but they can make it harder to interact with it properly.

FATF suggest that VASPs (i.e. cryptocurrency exchanges) limit withdrawals or even refuse transactions from self-custodial wallets. They want to bend the new systems under the status quo.

They push rules against so-called “unhosted” wallets that let you hold your own money without a bank. You know, attacking the whole philosophical ethos of Bitcoin. They call it “unhosted” but actually in the crypto space it is called, with a more empowering term, “self-custodial”.

Indeed, regulators have started calling all cryptocurrencies as cryptoassets. It is a subtle change that shifts the view of Bitcoin and crypto into something like a stock or a collectible. It makes it easier to regulate and tax cryptocurrencies instead of recognising them as a new form of cash.

This is as much a linguistic and semantic tug-of-war as philosophical and regulatory.

The powerful compliance-industrial complex is quietly attempting to make Bitcoin and crypto a “Walled Garden”.

Mikko Ohtamaa gives more examples. In Seychelles, for instance, lawmakers tried to treat private wallets just like banks, stripping away the non-custodial category entirely. In Estonia, a compliance firm lobbied to make wallet developers register as financial services. In Denmark, regulators are pushing rules that force every crypto interface—from web-wallets to apps—to collect KYC data.

Why? Business as usual: profit and power. Lawyers, compliance vendors and bureaucrats thrive on heavier regulation, selling expensive solutions and padding their salaries, while ordinary users face higher fees, fewer choices and the loss of privacy.

Soon the only way to buy and hold Bitcoin is through your bank—where the bank keeps your keys, brakes your profits with hidden fees, and hands you just enough yield to keep you quiet.

But laws alone cannot stop human habits and shared beliefs. That is where norms—unwritten rules—come in. A law is a rule written on paper; a norm is a rule people live by. For example, in 2016 the Indian government suddenly banned large banknotes. By law, people could not use those notes. In practice, shops, friends, and local markets still accepted cash because that is how life worked. It was the norm.

The same thing happens with crypto. Even if China bans Bitcoin trading or the US blocks certain wallets, people teach each other how to trade in private, set up underground markets, and share simple guides on securing coins out of need. Unfortunately, as they say, if privacy is outlawed, then only outlaws will have privacy.

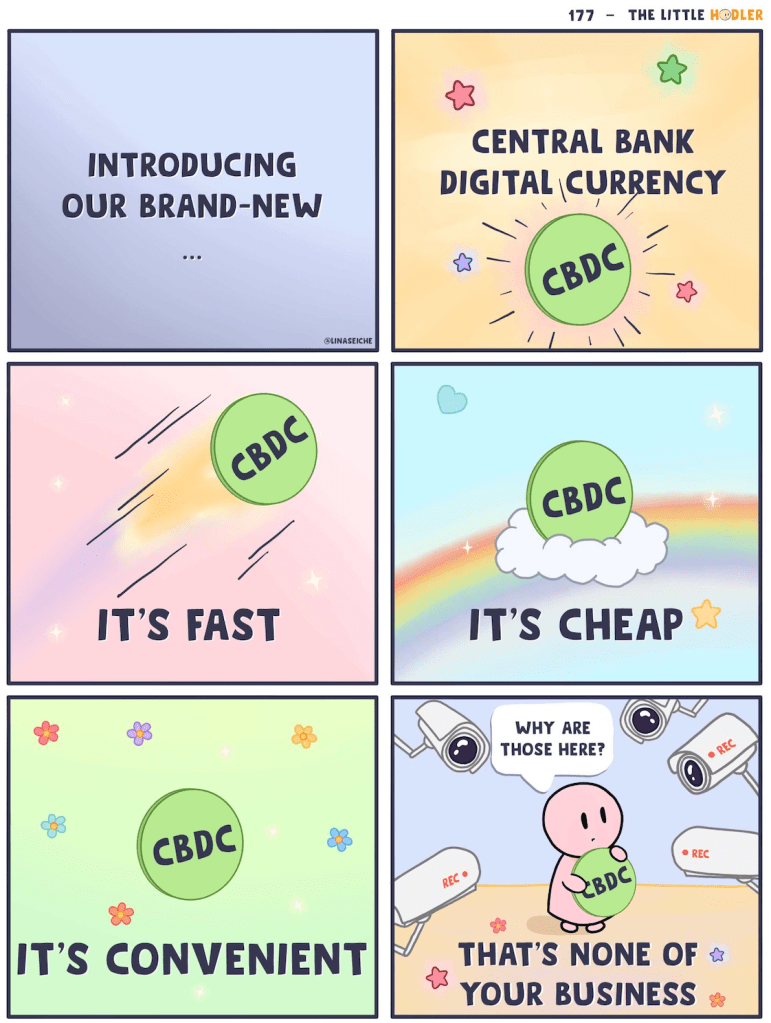

Meanwhile, central banks race to build their own digital currencies (CBDCs). A CBDC is simply a digital token issued by a government bank. It promises fast, cheap payments, but it also hands authorities the power to see every purchase. The powerful in Frankfurt can block funds based on your political views, only allow spending at certain stores, or even set expiry dates on your money.

This vision of total control has almost nothing to do with the basic property laws that protect ownership of land, stocks, or even cash today. Those laws exist to give people confidence to invest and trade. When governments build CBDCs, they are not strengthening property rights—they are layering on new rules that could weaken them.

It is quite clear to me: technology that empowers individuals will meet resistance in the courts, in regulations, and in public debate. Labelling encryption “terrorism” could not stop demand for privacy. In the same way, calling Bitcoin a “cryptoasset”, imposing wallet limits, and banning privacy tools will not stop people from seeking financial freedom.

8 conclusion

Once upon a time many said that “Bitcoin is a solution seeking a problem”. As we have seen, Bitcoin solves real contemporary problems.

It offers dematerialised wealth storage without competing with housing markets. It provides a stable measuring unit in an unstable world. It enables micropayments that free content from surveillance capitalism. It helps stabilise energy grids and helps fund local endeavours. It creates censorship-resistant donation channels for activists in autocratic regimes.

But powerful institutions are fighting to contain Bitcoin and crypto and seek rent from it. Regulators label cryptocurrencies as “assets” to change perception. The compliance industry pushes for restrictions on self-custody. Central banks develop digital currencies for control rather than freedom.

Still Bitcoin continues to grow because it helps people. Like earlier battles over encryption, attempts to control Bitcoin through regulations or social pressure can slow but not stop its adoption.

Bitcoin is a more ethical foundation for transparent, fair, and resilient economic future. Not through force, but through free choice and better money.

Leave a comment